is an oversold stock bad

When a stock is overbought with an RSI above 70 all that means is that the price has gone up a lot thats it. One of the worst rookie mistakes of technical analysts is to think of overbought as bad and oversold as good.

What Does An Oversold Stock Mean Would It Be A Good Buy Quora

Oversold refers to a market state when prices have gone down excessively and therefore are likely to reverse to the upside in the near future.

. It does mean however that the stock may not be a good value at that price. A big company might be about to release bad news that would hurt its share price. Generally an oversold stock suffers from overreacting traders.

On its own this doesnt suggest negativity but tells you the uptrend has been strong. My own OverboughtOversold Oscillator for the New York Stock Exchange is not fully oversold but Nasdaqs is. In that case the stock value dips down very rapidly.

Traders see RSI values above 70 as signs of overbought positions. It also presents a possible opportunity for making gains. Theoretically an investor might see excellent trading results by doing nothing other than only buying stocks with an RSI of 20.

While it is possible that an extremely overbought or oversold stock will become even more overbought or oversold such an outcome becomes increasingly unlikely the further to the extremes the RSI reaches. For this indicator I use the 10-day moving average of the net of the advancedecline. Bad News Generates Rally in a Highly Oversold Market The market has been so oversold in the past five weeks that even a bad news.

RSI stands for Relative Strength Index. The opposite of an overbought stock is an oversold stock. When a stock is oversold it trades at a price below its intrinsic value.

When a stock is oversold the implication is that selling has pushed the price too far down and a reaction called a price bounce is expected. Suppose a stock value suddenly falls because of issues in the company bad reports or any mass withdrawals of traders believing that the stock may be overpriced. One of the worst rookie mistakes of technical analysts is to think of overbought as bad and oversold as good.

This as the name implies reflects a stock that appears to be worth more than the price it is trading at. Its 14-day RSI relative strength index is 6532. If a stock is oversold it means that the number of sellers outweighs the number of buyers.

Cramer says stocks are still badly oversold even after Wall Streets big rally Published Thu Dec 2 2021 708 PM EST Updated Thu Dec 2 2021 745 PM EST Matthew J. This means that its. When a stock becomes oversold though its a good thing for new investors.

As opposed to overbought oversold means that stock prices have decreased substantially. RSI values below 30 are seen as oversold positions. A stock can become undervalued as a result of a major sell-off.

Although oversold is mostly used when analyzing stocks and equities it can be used to describe other markets that share the mean-reverting traits of the stock market. An oversold condition can last for a long time and therefore being oversold doesnt mean a price rally will come soon or at all. As a result investors sell shares before the news comes out and the price falls.

Many technical indicators identify oversold and overbought levels. Traders and investors need to identify the reasons of such price decline in order to. Fundamentally oversold stocks or any asset are those that investors feel are trading below their true valueThis could be the result of bad news regarding the company in question a poor outlook for the company going forward an out of favor industry or a sagging overall market.

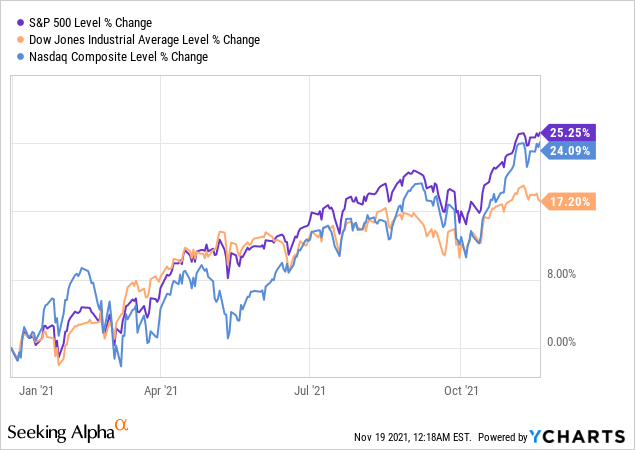

Another scenario is when large buyers take out stop orders before the subsequent repurchase at a better price. The share price would go on to rise from under 36 up to a. The stock markets 4 decline over the past week doesnt sound bad given that the SP 500 is up 22 year-to-date and yet investors are still on.

Put simply it trades at a price thats much lower than it should. Why Stocks are Overbought and Oversold. When analysts state that a stock is overbought it does not mean that the stock is a bad stock.

Was even more oversold at the time as the stock was at an RSI level of just 26. When a stock is overbought with an RSI above 70 all that means is that the price has gone up a lot - thats it. Why does a stock become oversold.

You can buy the stock and sometimes see quick returns as it rebounds. On its own this doesnt suggest negativity but tells you the uptrend has been strong. This can happen for many reasons such as.

Usually an RSI below 30 indicates an oversold stock.

Market Oversold The Best Way To Tell If The Market Is Oversold

What Does An Oversold Stock Mean Would It Be A Good Buy Quora

Oversold Stocks Intraday Marketvolume Com

Determining Overbought And Oversold Conditions Using Indicators

/dotdash_Final_Oversold_Dec_2020-01-83bb8abb9e44484986e604f4bcbacc5a.jpg)

Oversold Definition And Example

10 Oversold Stocks That Could Explode Higher At Any Moment Seeking Alpha

Forget Warning Signs Stocks Are Now Extremely Overbought Seeking Alpha

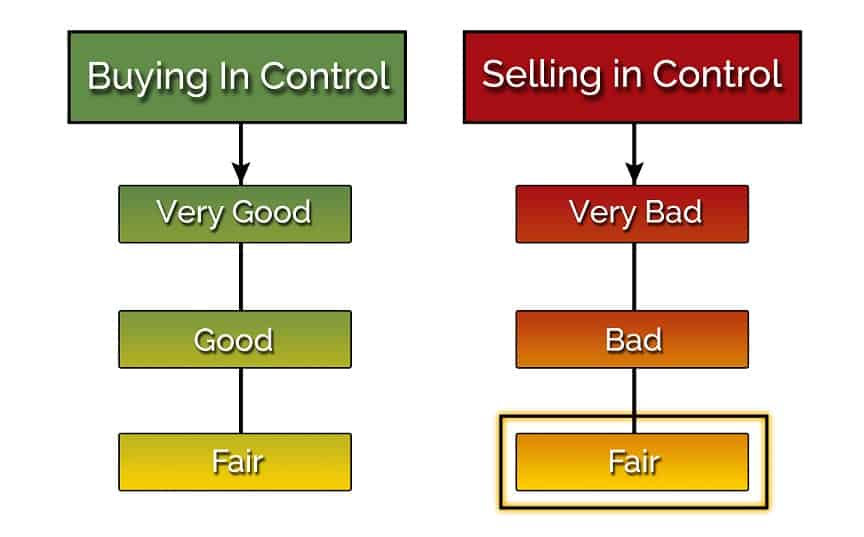

Overbought Vs Oversold And What This Means For Traders

If A Stock Is Oversold Does That Mean There Are More Buyers Than Sellers Is That A Good Thing Or A Bad Thing Quora

Forget Warning Signs Stocks Are Now Extremely Overbought Seeking Alpha

Overbought Vs Oversold And What This Means For Traders

If A Stock Is Oversold Does That Mean There Are More Buyers Than Sellers Is That A Good Thing Or A Bad Thing Quora

:max_bytes(150000):strip_icc()/dotdash_Final_Oversold_Dec_2020-01-83bb8abb9e44484986e604f4bcbacc5a.jpg)

Oversold Definition And Example

Oversold Definition And Example

If A Stock Is Oversold Does That Mean There Are More Buyers Than Sellers Is That A Good Thing Or A Bad Thing Quora

:max_bytes(150000):strip_icc()/dotdash_Final_Overbought_Sep_2020-013-385b6e73c3ce438e939375ab17150be1.jpg)

/dotdash_Final_Oversold_Dec_2020-01-83bb8abb9e44484986e604f4bcbacc5a.jpg)

/dotdash_Final_Overbought_Sep_2020-013-385b6e73c3ce438e939375ab17150be1.jpg)